UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| þ | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

| SPOK HOLDINGS, INC. | ||||

| (Name of Registrant as Specified in its Charter) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| þ | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(41) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Notice of Annual Meeting of Stockholders

June 10, 20158, 2017

Dear Fellow Stockholder:

It is my pleasure to invite you to join us at the 20152017 Annual Meeting of Stockholders of Spok Holdings, Inc. to be held on Wednesday,Monday, July 29, 201524, 2017 at 9:10:00 a.m., Eastern Time,Time. We are very pleased that this year's annual meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the annual meeting of stockholders online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/SPOK2017. You will also be able to vote your shares electronically at the Mandarin Oriental, Room Garden I, 1330 Maryland Avenue SW, Washington, DC 20024.annual meeting.

We are pleased to use the latest technology to increase access, to improve communication and to obtain cost savings for our stockholders and the Company. Use of a virtual meeting will enable increased stockholder attendance and participation as stockholders can participate from any location.

Details regarding how to attend the meeting online and the business to be conducted at the annual meeting are more fully described in the Notice of Annual Meeting and Proxy Statement.

At this year’s meeting, we will vote on the election of 7seven directors, and the ratification of the selectionappointment of Grant Thornton LLP as the Company’s independent registered public accounting firm.firm and on an amendment to the Company's 2012 Equity Incentive Award Plan. We will also conduct a non-binding advisory vote to approve the compensation of the Company’s named executive officers for 2016 and a non-binding advisory vote on the frequency of future advisory votes to approve the compensation of the Company's named executive officers.

We usefollow the U.S. Securities and Exchange Commission rule that allows companies to furnish proxy materials to their stockholders over the Internet. We believe this expedites stockholdersstockholders' receipt of proxy materials, lowers the annual meeting costs and conserves natural resources. Thus, we are mailing to many stockholders a Notice of Internet Availability of Proxy Materials (“Notice”), rather than copies of the Proxy Statement and our Annual Report to Stockholders for the fiscal year ended December 31, 2014.2016. The Notice contains instructions on how to access the proxy materials online, vote online and obtain your copy of our proxy materials. The Notice or a full set of proxy materials will be mailed to stockholders on or about June 8, 2017.

Your voice is very important. Regardless of whether you plan to participate in the annual meeting, I encourage you to sign and return your proxy card, or use telephone or Internet voting prior to the meeting, so that your shares of common stock will be represented and voted at the meeting.

| Sincerely, |

| /s/Royce Yudkoff |

| Royce Yudkoff |

| Chair of the Board of Directors |

Spok Holdings, Inc. Notice of 2017 Annual Meeting of Stockholders | |

| DATE AND TIME: | |

| PLACE: | |

| ITEMS OF BUSINESS: | 1.To elect seven nominees as directors to the Board of Directors; 2.To ratify the 3. To hold a non-binding advisory vote to approve 2016 named executive officer compensation ("Say-on-Pay"); 4.To hold a non-binding advisory vote on 5. To approve an amendment to the Company's 2012 Equity Incentive Award Plan; and |

| WHO CAN VOTE: | You must be a stockholder of record at the close of business on |

| INTERNET AVAILABILITY: | We are using the Internet as our primary means of furnishing proxy materials to most of our stockholders. Rather than sending |

| PROXY VOTING: | We cordially invite you or your legal representative to participate in the Annual Meeting, either by attending and voting |

| ADMISSION TO THE ANNUAL MEETING: | You are entitled to attend the virtual Annual Meeting if you were a stockholder of record as of the close of business on Annual Meeting. |

| By Order of the Board of Directors, |

| /s/Sharon Woods Keisling |

| Sharon Woods Keisling |

| Corporate Secretary and Treasurer |

| Springfield, Virginia |

| PROXY STATEMENT TABLE OF CONTENTS | |||

i

ii

| PROXY STATEMENT SUMMARY |

This summary highlights information about Spok Holdings, Inc. (the “Company,” “Spok,” “we,” “our” or “us”) (formerly USA Mobility, Inc.) and certain information contained elsewhere in this proxy statement (“Proxy Statement”) for our 20152017 Annual Meeting of Stockholders (the “2015 Annual“Annual Meeting”). This summary does not contain all of the information that you should consider in voting your shares and you should carefully read the entire Proxy Statement. Spok, Inc. is our operating subsidiary and is an indirect wholly owned subsidiary of Spok.

VOTING MATTERS AND BOARD OF DIRECTOR RECOMMENDATIONS

Proposal | Board Vote Recommendations | Page Reference |

| 1. Election of Seven Directors | FOR Each Nominee | |

| 2. Ratification of the Appointment of Independent Registered Public Accounting Firm | FOR | |

| 3. Advisory Vote to Approve Named Executive Officer Compensation for 2016 (“Say-on-Pay”) | FOR | |

| 4. Advisory Vote on the Frequency of Future Say-on-Pay Votes (“Say-When-on-Pay”) | FOR EVERY YEAR | |

| 5. Approve an Amendment to the Company's 2012 Equity Incentive Award Plan | FOR | |

BOARD OF DIRECTORS NOMINEES

You are being asked to vote on the following seven nominees for director. Each director is elected annually by a pluralitymajority of the vote properlyvotes cast. Further information about each director can be found starting on page 58.52.

| Name | Age | Director Since | Principal Occupation | Independent | Board Committee* |

| N. Blair Butterfield | 60 | 2013 | Chairman, Wind River Advisory Group LLC | Yes | AC |

| Stacia A. Hylton | 57 | 2015 | Retired Director, United States Marshal Service | Yes | AC |

| Vincent D. Kelly | 57 | 2004 | President and Chief Executive Officer, Spok Holdings, Inc. | No | |

| Brian O’Reilly | 57 | 2004 | Retired Managing Director, Toronto Dominion Bank | Yes | CC Chair, NC |

| Matthew Oristano | 61 | 2004 | Chairman and Chief Executive Officer, Reaction Biology Corporation | Yes | AC Chair |

| Samme L. Thompson | 71 | 2004 | Owner and President Telit Associates, Inc. | Yes | CC, NC Chair |

| Royce Yudkoff | 61 | 2004 | Co-Founder, ABRY Partners, LLC | Yes | CC, NC |

*AC – Audit Committee; NC – Nominating and Governance Committee; CC – Compensation Committee

1

CORPORATE GOVERANCEGOVERNANCE HIGHLIGHTS

| - Annual election of directors by majority of votes cast (in uncontested elections) - No - 6 of our 7 directors are independent - Chair of the Board of Directors is an independent director - All Board committees consist solely of independent directors | - Stock ownership guidelines for directors and executive officers - Policies prohibiting hedging and pledging of our stock - Compensation "clawback" policy - Comprehensive Code of Business Conduct and Ethics guidelines - Strong pay-for-performance philosophy - Regular executive sessions of independent directors |

STOCKHOLDER ENGAGEMENT

We value our stockholders input and interact with our stockholders in a variety of ways. In 2014, we contacted2016 our top 25 stockholders representing approximately 67%stockholder engagement included 1) conducting quarterly reviews of our outstanding shares to solicit feedbackfinancial and explainoperating results, 2) meeting individually with investors and other interested parties who requested meetings with management, and 3) speaking with our strategy on corporate governance and executive compensation. Certain of theselargest stockholders declinedthroughout the year. We welcome the opportunity to meet with management, however, we did meet with stockholders representing approximately 37% of our shares outstanding. We also sponsored an investor day in November 2014 in New York City and quarterly meet with investors to review our quarterly operating and financial results.stockholders. Our Investor Relations professional is the contact point for stockholder interaction with the Company. InvestorsStockholders can reach us at (800) 611-8488 or via email at Bob.Lougee@spok.com.

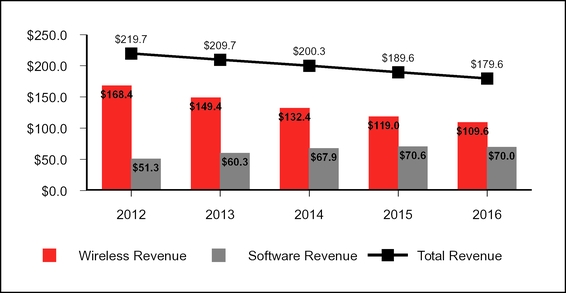

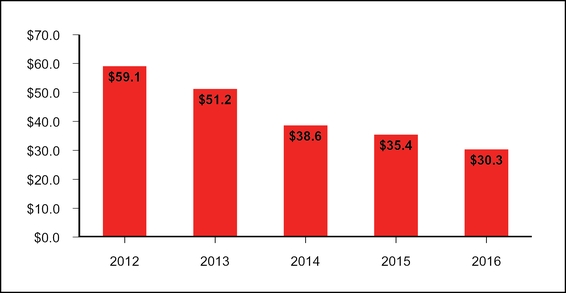

Corporate Summary

With the acquisition of theour software operations in 2011 the Company has begun a long-term transition from a declining narrow-band wireless centriccommunications service provider to become the leading developer of software solutions for critical communications, alerting and work flow efficiency for our most important customer base to a growing software centric critical communications customer base.in healthcare providers. This means that until our software revenue growth exceeds the decline in our wireless revenue, total consolidated revenue will decline. This also means that operating cash flow (a non-GAAP financial measure) will also decline year over year until the Company successfully transitions to growth. Both consolidated revenue and operating cash flow, along with software operations bookings, have been identified by the Compensation Committee as key drivers of stockholder value during this transition.

In 2016 we undertook our 2013Project “Catapult” plan which marked a shift in our strategic direction for healthcare, our largest customer segment. Catapult was initially created as a five year plan that signaled a very intentional move from offering our customers “point” solutions, or single product solutions, for call center software, alarm management and secure messaging to offering customers a single enterprise integrated platform called Spok Care Connect®. Becoming the leader in healthcare communication and collaboration requires us to continue development of our integrated platform and invest in the key areas of customer need including: 1) mobility, 2) integrated platform, 3) nursing solutions and 4) alerting. We will increase our spending on product development and strategy in 2017 and beyond to develop these solutions and compete in the changing marketplace.

2

In our 2015 Annual Report on Form 10-K, filed with the U.S. Securities and Exchange Commission ("SEC"), we outlined the following operating objectives and priorities for 20142016 as part of our transition from our wireless centric business model to a growth oriented critical communications model. Our 20142016 achievement of those operating objectives and priorities areis summarized below:

1)Grow our software revenue and bookings. | Annual software revenue fell 0.9% compared to 2015. Software operations bookings were 87.1% of 2015 software operations bookings. |

| 2)Retain our wireless subscribers and revenue stream. | Net churn for wireless subscribers in 2016 was 5.3% versus 6.6% in 2015. Wireless revenue declined 7.9% in 2016 versus a decline of 10.1% in 2015. |

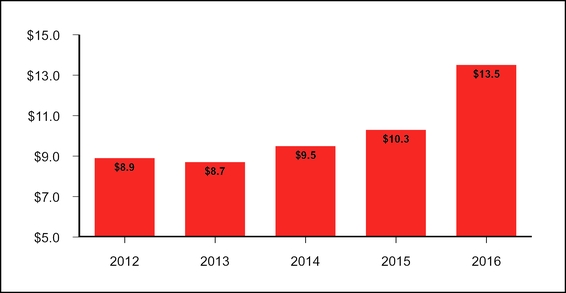

| 3) Invest in our future solutions. | Research and development expenses increased by 31.0% to $13.5 million in 2016. |

| 4) Return capital to our stockholders. | Cash dividends declared in 2016 were $15.5 million and common stock repurchases were $6.5 million. The Company exceeded its goal to return $21 million to stockholders in 2016. |

| 5) Seek long-term revenue growth through business diversification. | |

For more information regarding Spok’s 20142016 performance, please see our Annual Report to Stockholders for the year ended December 31, 20142016 (“20142016 Annual Report”).

COMPENSATION PROGRAM HIGHLIGHTS

Annual base salary amounts for named executive officers (“NEOs”)continuing NEOs remained unchanged from 2013.2015 with the exception of Bonnie Culp, Executive Vice President, Human Resources and Chief Compliance Officer who received a raise to $225,000.

The 20142016 short-term incentive plan (“20142016 STIP”) paid 112.5%107.4% of the incentive target for each NEO based on achievement of the pre-established performance goals.

The Company granted Restricted Stock Units (“RSU”) to selected executives in January 2016 under the 2015 Long Term Incentive Plan (“LTIP”) conditioned upon achieving performance cyclegoals for the 2011 long-term incentive plan (“2011 LTIP”) concluded onthree years ending December 31, 2014 with achievement of the pre-established performance goals. Payment of vested restricted stock units (“RSUs”) was made in shares of Spok’s common stock in March 2015.2018.

Stock ownership guidelines were establishedremain in effect for all executive officers, including NEOs (excluding the CEO). Stock ownership guidelines for the CEO were increased in 2014. Stock ownership guidelines forand the independent directors had already been established.directors.

Policies prohibiting pledging and hedging of our stock for all executive officers, including NEOs, were established.remain in effect.

A “clawback” policy for adjustment or recovery of compensation in certain circumstances was established.remains in effect.

3

KEY GOVERANANCEGOVERNANCE ELEMENTS IN OUR EXECUTIVE COMPENSATION PROGRAM

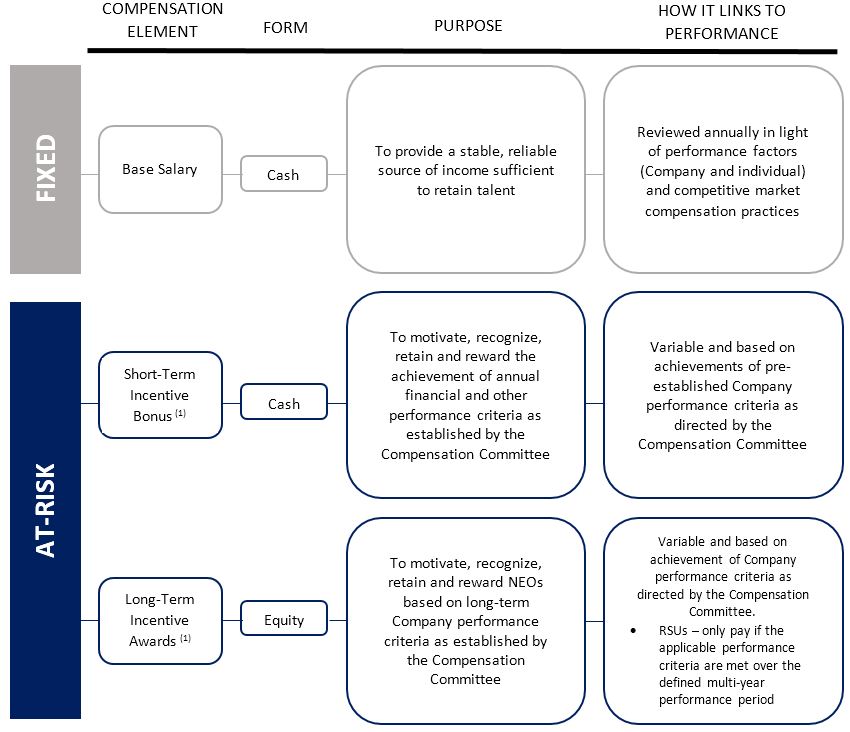

The following is a summary of specific elements of our 2016 executive compensation program designed to align the interests of our stockholders and executivesexecutives.

| Corporate Governance | ||

l We provide meaningful at risk elements of compensation for | l We generally do not enter into individual executive compensation agreements. Only our CEO has an employment contract. | |

l Equity-based LTIP awards for 2016 are 100% performance based and align with stockholder value. | l We devote significant time to strategic development and linkage of quantifiable results to executive compensation. | |

l Actual realized total compensation is designed to fluctuate with, and be commensurate with, actual performance. | l We maintain a market-aligned severance policy for executives upon a change in control. No excise tax gross ups are provided to our executives. | |

l LTIP awards vest upon a change in control only if we are on track to meet our performance goals. No other "single trigger" benefits apply upon a change in control for any of our NEOs. | ||

l Incentive awards for 2016 were 100% dependent upon our performance, and are measured against objective financial metrics that are intended to link either directly or indirectly to the creation of value for our stockholders. | l The Compensation Committee uses an independent compensation consultant when seeking outside recommendations. | |

l We balance growth and return objectives, top and bottom line objectives, and short- and long-term objectives to reward overall performance that does not over-emphasize a singular focus. | l Our compensation programs do not encourage imprudent risk-taking. | |

l Our long-term incentives for financial metricsare achieved. | any form of | |

l We conduct a stockholder outreach program throughout the year. | ||

l We disclose our corporate performance goals and achievements relative to our STIP goals each year. | ||

4

| QUESTIONS AND ANSWERS ABOUT THE |

1. WHY DID I RECEIVE THESE PROXY MATERIALS?

Our Board of Directors (“Board”) is soliciting your proxy. Your proxy will be voted at the 2015 Annual Meeting on July 29, 201524, 2017 at 9:10:00 a.m. Eastern Time at the Mandarin Oriental, Room: Garden I, 1330 Maryland Avenue SW, Washington, DC 20024 and at any adjournment(s) or postponement(s) of such meeting. All properly executed written proxies and all properly completed proxies submitted by telephone or by the Internet that are delivered pursuant to this solicitation will be voted at the meetingAnnual Meeting in accordance with the directions given in the proxy, unless the proxy is revoked before completion of voting at thesuch meeting.

2. WHAT IS THE RECORD DATE AND WHAT DOES IT MEAN?

The Record Date for the 2015 Annual Meeting is June 3, 2015.May 30, 2017. Only stockholders of record on our transfer books at the close of trading on the NASDAQ National Market System on the Record Date will be entitled to vote atand attend the Annual Meeting. On April 1, 20152017 there were 21,739,41220,530,795 shares of our common stock outstanding. Holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders.

3. WHAT IS THE DIFFERENCE BETWEEN A STOCKHOLDER OF RECORD AND A

STOCKHOLDER WHO HOLDS STOCK IN STREET NAME?

If your shares of stock are registered in your name on the books and records of our transfer agent, you are the stockholder of record. If your shares of stock are held for you in the name of your broker, bank or other nominee, your shares are held in street name. The answer to Question 10 describes brokers’ discretionary voting authority and when your broker, bank or other nominee is permitted to vote your shares of stock without instructions from you.

It is important that you vote your shares if you are a stockholder of record and, if you hold shares in street name, that you provide appropriate voting instructions to your broker, bank or other nominee as discussed in the answer to Question 10.

4. WHAT ARE THE DIFFERENT METHODS THAT I CAN USE TO VOTE MY SHARES OF

COMMON STOCK?

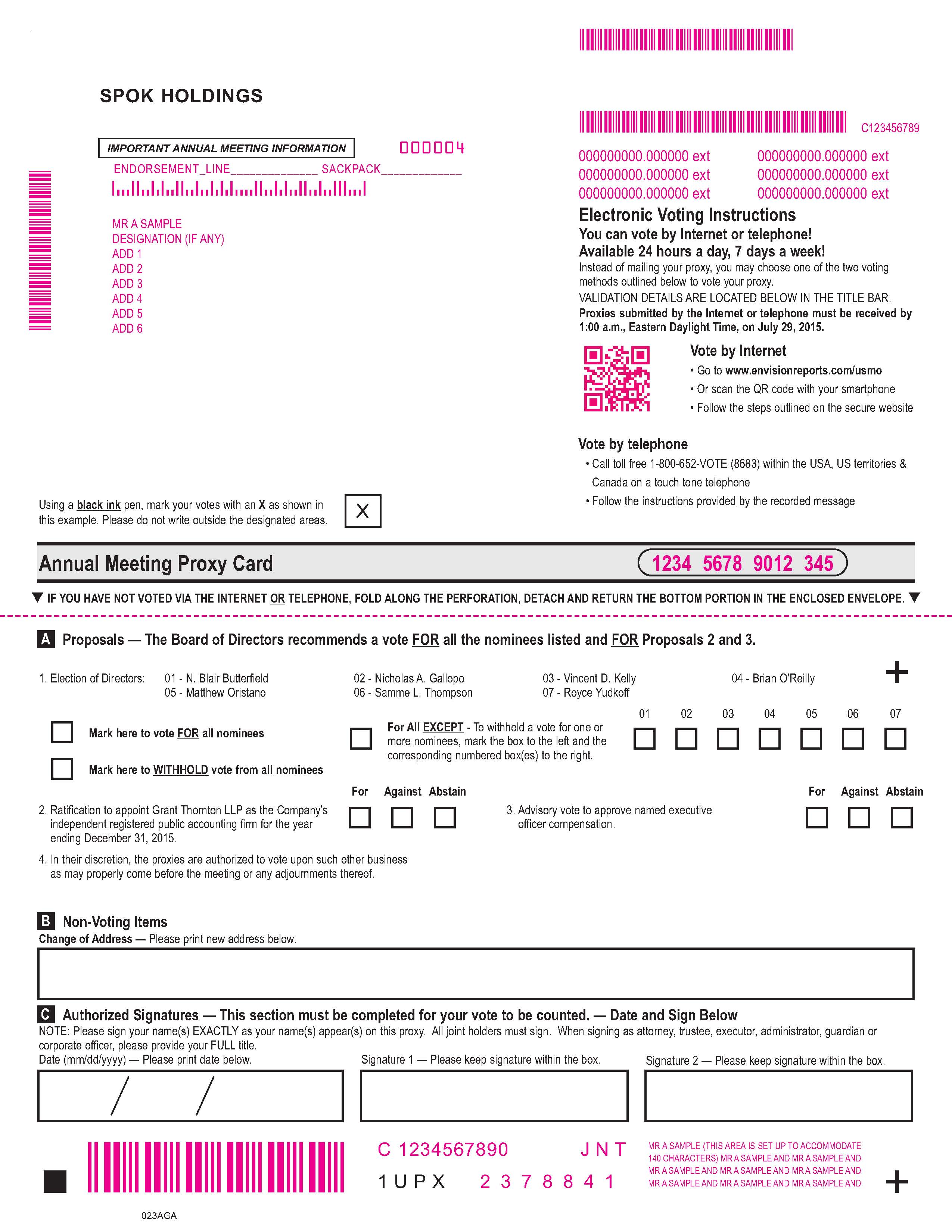

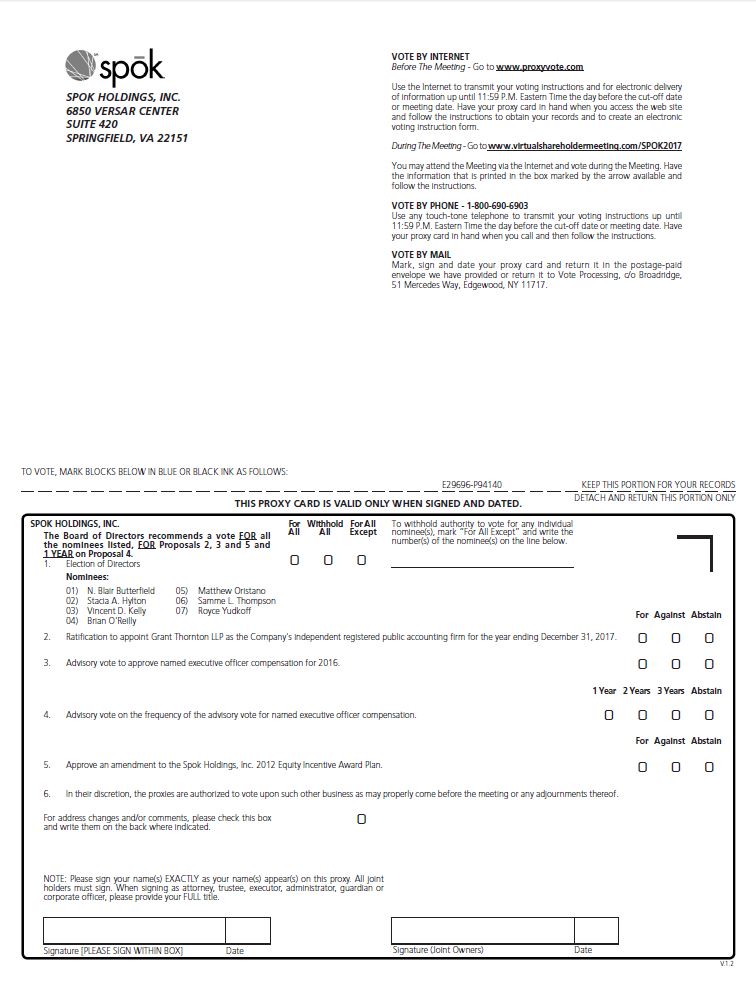

By Telephone or Internet Proxy:Internet: All stockholders of record may vote their shares of common stock by touch-tone telephone using the telephone number on the proxy card (withinor Notice of Internet Availability of Proxy Materials ("Notice")(within the United States, U.S. territories and Canada, there is no charge for the call), or by the Internet, using the procedures and instructions described on the proxy card or Notice and other enclosures. Street name holders may vote by telephone or the Internet if their brokers, banks or other nominees make those methods available. If that is the case, each broker, bank or other nominee will enclose instructions along with the Proxy Statement.Notice or proxy materials received from the Company. The telephone and Internet voting procedures, including the use of control numbers, are designed to authenticate stockholders’ identities, to allow stockholders to vote their Sharesshares and to confirm that their instructions have been properly recorded.

In Writing: All stockholders also may vote by mailing their completed and signed proxy card (in the case of stockholders of record) or their completed and signed voting instruction form (in the case of street name holders).

www.virtualshareholdermeeting.com/SPOK2017

To participate in the Annual Meeting, you will need the 16-digit control number included in yourNotice, on your proxy card or on the instructions that accompanied your proxy materials.

Shares held in your name as the stockholder of record may be voted electronically during the Annual Meeting. Shares for which you are the beneficial owner but not the stockholder of record also may be voted on electronically during the Annual Meeting.

Even if you plan to participate in the online Annual Meeting, we recommend that you also vote by proxy as described above so that your vote will be counted if you later decide not to participate in person at the meeting. Street name holders must obtain a legal proxy from their broker, bank or other nominee and bring the legal proxy to the meeting in order to vote in person at the meeting.Annual Meeting.

5

5. WHAT ITEMS WILL BE VOTED ON AT THE 2015 ANNUAL MEETING?

Proposal Proposal 1 – Election of Directors (pages 52-55) | Voting Choices, Board Recommendation and Voting Requirement Voting Choices · Vote for · Vote against · Abstain from voting. Board Recommendation The Board recommends a vote “FOR” each of the nominees named in the Proxy Statement. Voting Requirement Directors will be elected by |

Proposal 2 – Ratification of | Voting Choices · Vote for the ratification; · Vote against the ratification; or · Abstain from voting. Board Recommendation The Board recommends a vote “FOR” this proposal. Voting Requirement The |

Proposal 3 – Advisory Vote to Approve | Voting Choices · Vote for the approval of the compensation of the Company’s named executive officers; · Vote against the approval of the compensation of the Company’s named executive officers; or · Abstain from voting. Board Recommendation The Board recommends a vote “FOR” this proposal. Voting Requirement The advisory approval of the compensation of the Company's named executive officers requires a majority of the votes cast. Thus, the compensation of the Company’s named executive officers will be approved on an advisory basis if the votes cast “FOR” exceed the votes cast “AGAINST”. This vote is not binding upon the Company, the Board or the Compensation Committee. Nevertheless, the Compensation Committee values the opinions expressed by stockholders in their vote on this proposal and will consider the outcome of the vote when making future compensation decisions for the Company’s named executive officers. |

6

Proposal 4 – Advisory Vote on the Frequency of Future Say-on-Pay Votes ("Say-When-on-Pay") (page 58) | Voting Choices · Vote for EVERY YEAR; · Vote for EVERY TWO YEARS; · Vote for EVERY THREE YEARS; or · Abstain from voting. Board Recommendation The Board recommends a vote for EVERY YEAR. Voting Requirement The advisory vote on the frequency of future Say-on-Pay votes requires a majority of the votes cast for approval. Thus, the option of EVERY YEAR, EVERY TWO YEARS or EVERY THREE YEARS will be approved on an advisory basis if the votes cast for such option exceed the votes cast for the other alternatives. In the event that no option receives a majority of the votes cast, the option that receives the most votes will be considered the option recommended by stockholders. This vote is not binding upon the Company, the Board or the Compensation Committee. Nevertheless, the Compensation Committee values the opinions expressed by stockholders in their vote on this proposal and will consider the outcome of the vote when making decisions on the frequency of future Say-on-Pay votes. |

Proposal 5 – Amendment to the Company's 2012 Equity Incentive Award Plan (“2012 Equity Plan”) (page 59-65) | Voting Choice · Vote for the approval of the amendment to the Company’s 2012 Equity Plan; · Vote against the approval of the amendment to the Company’s 2012 Equity Plan; or · Abstain from voting. Board Recommendation The Board recommends a vote “FOR” this proposal. Voting Requirement The approval of the amendment to the Company’s 2012 Equity Plan requires a majority of the votes cast. Thus, the amendment of the 2012 Equity Plan will be approved if the votes cast “FOR” exceed the votes cast “AGAINST”. |

7

6. ARE VOTES CONFIDENTIAL?

We will continue our long-standing practice of holding the votes of each stockholder in confidence from directors, officers and employees, except: (a) as necessary to meet applicable legal requirements and to assert or defend claims for or against the Company; (b) in the case of a contested proxy solicitation; (c) if a stockholder makes a written comment on the proxy card or otherwise communicates his or her vote to the Company; or (d) to allow the independent inspectors of election to certify the results of the vote.

7. WHO COUNTS THE VOTES?

We will continue, as we have for many years, to retain an independent tabulator to receive and tabulate the Proxiesproxies and independent inspectors of election to certify the results. This year the tabulator will be Broadridge Financial Services.

8. WHAT IF A STOCKHOLDER DOES NOT SPECIFY A CHOICE FOR A MATTER WHEN

RETURNING A PROXY?

Stockholders should specify their voting choice for each matter on the accompanying proxy. If no specific choice is made for one or more matters, proxies that are signed and returned will be voted “FOR” the election of each of the nominees for director,director; “FOR” the proposal to ratifyratification of the selectionappointment of Grant Thornton LLP (“Grant Thornton”), as our independent registered public accounting firm for the year ending December 31, 2015 and2017; “FOR” the advisory vote to approve the compensation of the Company’s named executive officers.officers (“Say-on-Pay”); for “EVERY YEAR” as the frequency of future “Say-on-Pay” votes; and “FOR” the approval of the amendment to the 2012 Equity Plan.

9. WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE PROXY CARD?

It means that you have multiple accounts with brokers and/or our transfer agent. Please vote all of these shares.

We recommend that you contact your broker and/or our transfer agent to consolidate as many accounts as possible under the same name and address. Our transfer agent is Computershare Trust Company, N.A. Computershare’s address is P.O. Box 43078, Providence, Rhode Island 02940-3078. You can reach Computershare at 1-800-442-0077 (from within the United States or Canada) or 1-781-575-3572 (from outside the United States or Canada).

10. WILL MY SHARES BE VOTED IF I DO NOT PROVIDE MY PROXY?

Stockholders of Record: If you are a stockholder of record (see Question 3), your shares will not be voted if you do not provide your proxy unless you vote online during the Annual Meeting. We therefore encourage you, regardless of whether you plan to participate in personthe Annual Meeting, to sign and return your proxy card, or use telephone or Internet voting prior to such meeting, so that your shares of common stock will be represented and voted at the meeting. It is, therefore, important that you vote your shares.Annual Meeting.

Street Name Holders: If your shares are held in street name (see Question 3) and you do not provide your signed and dated voting instruction form to your bank, broker or other nominee, your shares may be voted by your broker, bank or other nominee, but only under certain circumstances. Specifically, under the NASDAQ National Market (“NASDAQ”) rules, shares held in the name of your broker, bank or other nominee may be voted by your broker, bank or other nominee on certain “routine” matters if you do not provide voting instructions. Only the ratification of the selectionappointment of Grant Thornton LLP as the Company’s independent registered public accounting firm is considered a “routine” matter for which brokers, banks or other nominees may vote uninstructed shares. The other proposals to be voted on at our meetingthe Annual Meeting (specifically, the election of director nominees, and the advisory vote to approve the compensation of the Company’s named executive officers)officers (“Say-on-Pay”), the advisory vote on the frequency of future Say-on-Pay votes, and the approval of the amendment to the 2012 Equity Plan) are not considered “routine” under the NASDAQ rules, so the broker, bank or other nominee cannot vote your shares on any of these proposals unless you provide to the broker, bank or other nominee voting instructions for each of these matters. If you do not provide voting instructions on a non-routine matter, your shares will not be voted on the matter, which is referred to as a “broker non-vote.”

8

11. ARE ABSTENTIONS AND BROKER NON-VOTES COUNTED?

Abstentions and broker non-votes will not be included in votethe totals of votes cast and will not affect the outcome of the vote at the 2015 Annual Meeting. Broker non-votes are described more particularly in Question 10 above.

12. HOW CAN I REVOKE A PROXY?

You can revoke a proxy before the completion of voting at the meetingAnnual Meeting by:

| (a) | giving written notice to the Corporate Secretary of the Company; |

| (b) | delivering a later-dated proxy; or |

| (c) | voting |

Participation in the Annual Meeting will NOT cause your previously granted proxy to be revoked. To revoke you must use one of the methods listed above. For shares you held beneficially in the name of a broker, trustee or other nominee, you may change your vote by submitting new voting instructions to your broker, trustee or nominee, or by participating in the Annual Meeting and voting your shares online during such meeting.

13. WHO WILL PAY THE COST OF THIS PROXY SOLICITATION?

The cost of this solicitation of proxies will be paid by the Company. In addition to the use of mail, some of the officers and regular employees of the Company may solicit proxies by telephone and will request brokerage houses, banks, and other custodians, nominees and fiduciaries to forward soliciting material to the beneficial owners of common stock held of record by such persons. The Company will reimburse

such persons for expenses incurred in forwarding such soliciting material. It is contemplated that additional solicitation of proxies will be made in the same manner under the engagement and direction of GeorgesonBroadridge Investor Communication Solutions, Inc. (a subsidiary of Computershare Limited) at an anticipated cost of $18,000, plus reimbursement of out of pocket expenses. This cost includes support for the virtual Annual Meeting.

14. HOW DOCAN I OBTAIN ADMISSION TOATTEND THE 2015 ANNUAL MEETING?

You will be able to attend the Annual Meeting of record but holdstockholders online and submit your questions by visiting www.virtualshareholdermeeting.com/SPOK2017. You also will be able to vote your shares through a broker, bank, trustee or nominee (i.e.electronically at the Annual Meeting.

To participate in street name),the Annual Meeting, you will be requiredneed the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompanied your proxy materials.

The meeting webcast will begin promptly at 10:00 a.m., Eastern Time. We encourage you to provide proof of beneficial ownership as ofaccess the record date. Proof of beneficial ownership can take the form of your most recent account statementmeeting prior to the Record Date, a copy ofstart time. Online check-in will begin at 9:30 a.m. Eastern Time, and you should allow ample time for the voting instruction card provided by your broker, bank, trustee or nominee, a copy of the Notice of Internet Availability of Proxy Materials, if one was mailed to you, or similar evidence of ownership.check-in procedures.

15. MAY STOCKHOLDERS ASK QUESTIONS ATWHY IS THE 2015 ANNUALCOMPANY USING A VIRTUAL MEETING?

You will be able to attend the Annual Meeting of stockholders online and submit your questions of general interestby visiting www.virtualshareholdermeeting.com/SPOK2017. You also will be able to vote your shares electronically at the Annual Meeting.

9

16. WHAT IF DURING THE CHECK-IN TIME OR DURING THE ANNUAL MEETING I HAVE TECHNICAL DIFFICULTIES OR TROUBLE ACCESSING THE VIRTUAL MEETING WEBSITE?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the question and answer period of the meeting. In order to provide an opportunity for everyone who wishes to ask a question, each stockholder will be limited to two minutes. Stockholders may be asked to hold a second question until all others have first had their turn and ifcheck-in or meeting time, allows.please call:

17. HOW MANY VOTES MUST BE PRESENT TO HOLD THE 2015 ANNUAL MEETING?

Your shares are counted as present at the meeting if you attend the meeting and vote in persononline or if you properly return a proxy by Internet, telephone or mail. In order for us to conduct our meeting, a majority of our outstandingthe shares of common stock issued and outstanding and entitled to vote must be present in persononline or by proxy at the meeting. This is referred to as a quorum. Abstentions and shares of record held by a broker, bank or other nominee (‘broker shares”) that are voted on any matter are included in determining the number of shares present. Broker shares that are not voted on any matter will not be included in determining whether a quorum is present.

18. WHAT IF A QUORUM IS NOT PRESENT AT THE MEETING?

If a quorum is not present at the scheduled time of the Annual Meeting, then either the chairman of the Annual Meeting or the stockholders by vote of the holders of a majority of the stock present in person or represented by proxy at the Annual Meeting are authorized by our Bylaws to adjourn the Annual Meeting until a quorum is present or represented.

19. WHAT HAPPENS IF ADDITIONAL MATTERS ARE PRESENTED AT THE ANNUAL MEETING?

Other than the five items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Vincent D. Kelly and Michael Wallace, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If for any reason any of the nominees named in this Proxy Statement is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board.

20. WHERE CAN I FIND THE VOTING RESULTS OF THE ANNUAL MEETING?

We intend to announce preliminary voting results at the Annual Meeting and publish final results in a Current Report on Form 8-K to be filed with the SEC within four business days of the Annual Meeting or in our Quarterly Report on Form 10-Q if filed within four business days of the Annual Meeting.

| BOARD OF DIRECTORS AND GOVERNANCE MATTERS |

BOARD RESPONSIBILITY, COMPOSITION AND MEETINGS

The primary responsibility of the Board of Directors (the “Board”) is to foster the long-term success of the Company.Company and, in turn, to oversee the generation of long-term stockholder value. In fulfilling this role, each director must exercise his or her good faith business judgment of the best interests of the Company. The Board has responsibility for establishing broad corporate policies, setting strategic direction and overseeing management, which is responsible for the day-to-day operations of the Company.

Our Board consists of seven directors. Directors are elected annually at each annual meeting to serve until the next annual meeting and until their successors are duly elected and qualified, subject to their earlier death, resignation or removal. Each of the nominees currently serves as a director and was elected by the stockholders at the 20142016 Annual Meeting.Meeting of Stockholders. Biographical information and qualifications of the nominees for director are included under “Proposal 1 – Election of Directors” on page 57.52.

The Board holds regular meetings each quarter and special meetings are held when necessary. The Board’s organizational meeting follows the annual meeting of stockholders. Each year, one of the Board meetings is devoted primarily to reviewing the Company’s long-range plan. The Board held five5 meetings in 2014.2016. The Board meets in executive session at every Board meeting. Directors are expected to attend the Board meetings, the annual meeting of stockholders and meetings of committees of the Board on which they serve, with the understanding that, on occasion, a director may be unable to attend a meeting. During 20142016, all nominees for director attended 100% of the aggregate number of meetings of the Board and any standing committees of the Board on which they serve.served, except for two directors, one who missed one meeting and one who missed two meetings. All directors attended the 2014virtual 2016 Annual Meeting.Meeting of Stockholders.

BOARD LEADERSHIP STRUCTURE

The Board has segregated the positions of Chair of the Board and Chief Executive Officer and President (“CEO”) since the Company’s inception in 2004. The position of Chair of the Board has been filled by an independent director. The Board believes that segregation of these positions has allowed the CEO to focus on managing our day-to-day activities within the parameters established by the Board. The position of Chair of the Board provides leadership to the Board in establishing our overall strategic direction consistent with the input of other directors of the Board and management. The Board believes this structure has served the stockholders well by ensuring the development and implementation of our strategies in both the wireless telecommunications and software industries.critical communications market.

GOVERNANCE GUIDELINES, POLICIES AND CODES

The Board has adopted Corporate Governance Guidelines that may be found on our website at http://www.spok.com/our_company/investor_relations/.meet-spok/investor-relations. In addition, the Board has adopted a Code of Business Conduct and Ethics that applies to all our directors and employees including the CEO, Chief Financial Officer (“CFO”) and Controller/Chief Accounting Officer. This Code of Business Conduct and Ethics may be found on our website http://www.spok.com/our_company/investor_relations/.meet-spok/investor-relations. During the period covered by this report, we did not request a waiver of our Code of Business Conduct and Ethics and did not grant any such waivers. Should any amendment or waiver become necessary, we intend to post such amendments to or waivers from our Code of Business Conduct and Ethics (to the extent applicable to the Company’s directors, principal executive officersofficer, principal financial officer or principal financial officers)accounting officer) on our website. Information on the Company’s website is not, and shall not be deemed to be a part of this Proxy Statement or incorporated into any other filings the Company makes with the U.S. Securities and Exchange Commission (“SEC”).SEC.

BOARD’S RISK OVERSIGHT ROLE

Our primary risks consist of managing our business profitably withinduring the environmentcontinued transition of declining wireless revenues and subscribers and profitably expanding our software revenues and bookings. In general, the Board, as a whole and also at the committee level, oversees our risk management activities. The Board annually reviews management’s long-term strategiclong range plan and the annual budget that results from the strategic planning process. Using that information the Compensation Committee establishes both the short-term and long-term compensation programs along with the performance criteria that apply to all executives of the Company (including the NEOs). These compensation programs are discussed and ratified by the Board. The compensation programs are designed to focus management on the performance metrics that we expect will drive profitability in our business.business and long-term stockholder value. See “Compensation Discussion and Analysis –- Executive Compensation Design –- Compensation Policies and Risk Considerations” for additional information regarding risk management related to the Company’s compensation policies and procedures. The Board receives periodic updates from management on the status of our business and performance (including updates outside of the normal Board meetings). Finally, as noted below, the Board is assisted by the Audit Committee in fulfilling its responsibility for oversight of the quality and integrity of our accounting, auditing and financial reporting practices. Thus, in performing its risk oversight, the Board establishes the performance metrics, monitors on a timely basis the achievement of those performance metrics, and oversees the mechanisms that report those performance metrics.

COMMITTEES OF THE BOARD OF DIRECTORS

The Board has established various separately-designated standing committees to assist it with performance of its responsibilities. The Board designates the members of these committees and the committee chairs annually at its organizational meeting, which typically follows the annual meeting of stockholders, based on the recommendations of the Nominating and Governance Committee. The Chair of each committee works with Company management to develop the agenda for that committee and determine the frequency and length of committee meetings. After each meeting, each committee provides a full report to the Board.

The Board has adopted written charters for each of these committees. These charters are available on the Company’s website at http://www.spok.com/our_company/investor_relations/.meet-spok/investor-relations. The following table summarizes the primary responsibilities of the committees:

Committee Audit Compensation Nominating and Governance | Primary Responsibilities The Audit Committee assists the Board in its oversight of the integrity of the Company’s financial statements and financial reporting processes and systems of internal control; the qualifications, independence and performance of the Company’s independent registered public accounting firm, the internal auditors and the internal audit function and the Company’s compliance with legal and regulatory requirements. The Audit Committee also prepares the Audit Committee Report that the rules of the SEC require the Company to include in its proxy statement. See pages 17 The Compensation Committee determines, reviews and approves the compensation of the NEOs, including salary, annual short-term incentive awards and long-term incentive awards. The Compensation Committee reviews director compensation and recommends changes in compensation to the Board. In addition, the Compensation Committee evaluates the design and effectiveness of the Company’s incentive programs. See pages 19 The Nominating and Governance Committee identifies individuals qualified to become Board members consistent with the criteria established by the Board, which are described in the Company’s Corporate Governance Guidelines, and recommends a slate of nominees for election at each annual meeting of stockholders; makes recommendations to the Board concerning the appropriate size, function, needs and composition of the Board and its committees; advises the Board on corporate governance matters, including the development of recommendations to the Board on the Company’s corporate governance principles; and oversees the self-evaluation process of the Board and its committees. |

12

The following table sets forth the current members of each committee and the number of meetings held during 2014:2016:

Name N. Blair Butterfield* Nicholas A. Gallopo* Vincent D. Kelly Brian O’Reilly* Matthew Oristano* Samme L. Thompson* Royce Yudkoff*(4) | Audit(1) √ Chair √ √ | Compensation(2) Chair √ √ | Nominating and Governance(3) √ Chair √ |

| 2014 Meetings | 4 | 3 | 2 |

| Name | Audit(1) | Compensation(2) | Nominating and Governance(3) |

| N. Blair Butterfield* | √ | ||

| Stacia A. Hylton* | √ | ||

| Vincent D. Kelly | |||

| Brian O’Reilly* | Chair | √ | |

Matthew Oristano*(4) | Chair | ||

Samme L. Thompson*(5) | √ | Chair | |

Royce Yudkoff*(6) | √ | √ | |

| 2016 Meetings | 5 | 3 | 1 |

* Independent Director

| (1) | The Audit Committee consists entirely of non-management directors all of whom the Board has determined are independent within the meaning of the listing standards of |

| (2) | The Compensation Committee consists entirely of non-management directors all of whom the Board has determined are independent within the meaning of the listing standards of NASDAQ, are non-employee directors for the purposes of Rule 16b-3 of the Exchange Act; and satisfy the requirements of Internal Revenue Code Section 162(m) for outside directors. |

| (3) | The Nominating and Governance Committee consists entirely of non-management directors all of whom the Board has determined are independent within the meaning of the listing standards of NASDAQ. |

| (4) | Mr. Oristano became Chair of the Audit Committee in November 2016 after the death of Mr. Nicholas Gallopo, the former Chair of the Audit Committee. |

| (5) | Mr. Thompson became Chair of the Nominating and Governance Committee in November 2016 after Mr. Oristano became Chair of the Audit Committee. |

| (6) | Chair of the Board of Directors. |

DIRECTORS

Process for Nominating Directors

The Nominating and Governance Committee is responsible for identifying and evaluating nominees for director and for recommending to the Board a slate of nominees for election at the annual meeting.

In identifying potential candidates for Board membership, the Nominating and Governance Committee relies on suggestions and recommendations from directors, management, stockholders and others, including from time to time executive search and board advisory firms. The Nominating and Governance Committee has the sole authority to retain, compensate and terminate any search firm or firms to be used in connection with the identification and assessment of director candidates.

The Nominating and Governance Committee considers proposed nominees whose names are submitted to it by stockholders; however, it does not have a formal process for that consideration. We have not adopted a formal process because we believe that an informal consideration process has served stockholders well. The Nominating and Governance Committee intends to review periodically whether a more formal policy should be adopted. If a stockholder wishes to suggest a proposed name for the Nominating and Governance Committee’s consideration, the name of that nominee and related personal information should be forwarded to the Nominating and Governance Committee, in care of our Secretary, at least six months before the next Annual Meeting of Stockholders to ensure time for meaningful consideration by the Nominating and Governance Committee. The policy for nominating directors is the same regardless if the nominees are submitted to the Nominating and Governance Committee by stockholders or if the nominees are recommended by the Company or the Board. The Company’s Bylaws set forth the procedures that a stockholder must follow to nominate directors. (see(See “Stockholder Proposals and Company Documents” on page 65.69.)

The current composition of our Board of Directors is discussed under “Board Responsibility, Composition and Meetings” on page 10.11. Biographical information and qualifications of the nominees for director are included under “Proposal 1-Election of Directors” on page 57.52.

13

Director Qualifications and Board Diversity

The Nominating and Governance Committee considers Board candidates based upon various criteria, such as skills, knowledge, perspective, broad business judgment and leadership, relevant specific industry or regulatory affairs knowledge, business creativity and vision, experience and any other factors appropriate in the context of an assessment of the Nominating and Governance Committee’s understanding of the needs of the Board at that time. In addition, the Nominating and Governance Committee considers whether

the individual satisfies criteria for independence, as may be required by applicable regulations, and personal integrity and judgment. Accordingly, the Board seeks to attract and retain highly-qualified directors who have sufficient time to attend to their substantial duties and responsibilities to our Company.

The Nominating and Governance Committee is focused on diversity, and as part of its review of Board candidates, the Nominating and Governance Committee considers diversity in the context of age, business experience, knowledge and perspective from other fields or industries such as investment banking, manufacturing, professional services, government services or consulting among others. This consideration is included as part of the overall decision on the candidates for the Board.

Under “Proposal 1 – Election of Directors,” we provide our overview of each nominee’s principal occupation, business experience and other directorships, together with the key attributes, experience and skills considered by the Nominating and Governance Committee and the Board as relevant to achieving the Company’s strategic direction and overseeing its operations.

Director Independence Determinations

The NASDAQ corporate governance rules require that a majority of the Board be independent. No director qualifies as independent unless the Board determines that the director has no direct or indirect material relationship with the Company. In assessing the independence of its members, the Board examined the commercial, industrial, banking, consulting, legal, accounting, charitable and familiar relationships of each member. The Board’s inquiry extended to both direct and indirect relationships with our Company. Based upon both detailed written submissions by members of the Board and discussions regarding the facts and circumstances pertaining to each member, considered in the context of applicable NASDAQ corporate governance rules, the Board has determined for the year ended December 31, 20142016 that all directors were independent, with the exception of Mr. Kelly, our CEO.

Compensation of Directors

The Compensation Committee periodically reviews the competitiveness of director compensation, considers the appropriateness of the form and amount of director compensation and makes recommendations to the Board concerning such compensation with a view toward attracting and retaining qualified directors. There were no changes made to director compensation in 2014.2016.

14

The following table presents the cash and equity compensation elements in place during 20142016 for our non-executive directors:

| Type of Compensation | Non-Executive Director (excluding Chair of Audit Committee) | Chair of Audit Committee | Non-Executive Director (excluding Chair of Audit Committee) | Chair of Audit Committee |

Annual Cash Fee(1) | $45,000 | $55,000 | $45,000 | $55,000 |

Annual Restricted Stock Award Value | $60,000 | $70,000 | $60,000 | $70,000 |

| (1) | Both the cash fee and restricted stock award value are paid in quarterly installments. |

| (2) | Restricted stock vests one year following the grant date, subject to earlier vesting upon a change in control. |

The non-executive directors are reimbursed for any reasonable out-of-pocket Board related expenses incurred. There are no other annual fees paid to these non-executive directors. A director that is employed as an executive for our Company is not separately compensated for service as a director.

Director Compensation Table for 20142016

| Director Name | Fees Earned or Paid in Cash ($) | Restricted Stock Awards ($) | Total ($) | Fees Earned or Paid in Cash ($) | Restricted Stock Awards ($)(4) | Total ($) |

Royce Yudkoff (1) | 45,000 | 60,000 | 105,000 | 45,000 | 60,000 | 105,000 |

N. Blair Butterfield (1) | 45,000 | 60,000 | 105,000 | 45,000 | 60,000 | 105,000 |

Nicholas A. Gallopo | 55,000 | 70,000 | 125,000 | 55,000 | 70,000 | 125,000 |

Stacia A. Hylton(1) | 45,000 | 60,000 | 105,000 | |||

Brian O’Reilly (1) | 45,000 | 60,000 | 105,000 | 45,000 | 60,000 | 105,000 |

Matthew Oristano (1) | 45,000 | 60,000 | 105,000 | |||

Matthew Oristano (1)(3) | 45,000 | 60,000 | 105,000 | |||

Samme L. Thompson (1) | 45,000 | 60,000 | 105,000 | 45,000 | 60,000 | 105,000 |

| (1) | Included in the column “Restricted Stock Awards” is a total of |

| (2) | Included in the column “Restricted Stock Awards” is a total of |

| (3) | Mr. Oristano became Chair of the Audit Committee in |

| (4) | Amounts shown reflect the grant date fair value of the restricted stock awards as determined under FASB ASC Topic 718. For additional information, refer to note 5 of the audited financial statements that were included in the Company's 2016 Annual Report on Form 10-K. |

| (5) | Mr. Gallopo died in November 2016. The Board of Directors authorized full payment and |

Stock Ownership Guidelines for Non-Executive Directors and Prohibitions on Pledging and Hedging

The Board believes that stock ownership guidelines further align the interest of directors with those of the Company’s stockholders. The non-executive directors are required to hold shares of common stock and/or restricted stock equal to three times their annual cash compensation ($135,000 for each non-executive director and $165,000 for the Chair of the Audit Committee) as measured on June 30th of each year. All non-executive directors will have a three year grace period to reach the ownership threshold. All non-executive directors have met the stock ownership guidelines as of April 1, 2017 except for Ms. Hylton who has until June 30, 2015, except2018 to reach the ownership threshold for Mr. Butterfield who has through June 30, 2016 to meet the stock ownership requirement.non-executive directors.

The Company’s non-executive directors are not permitted to engage in hedging activities with respect to our stock and are not permitted to pledge their shares of our stock.

15

Board Tenure

The Nominating and Governance Committee, as part of its evaluation of nominees to the Board, reviewed the tenure of each nominee. Each nominee to the Board, except for Mr. Butterfield and Ms. Hylton, has been a director since 2004. The Nominating and Governance Committee considered the Company’s ongoing long-term transition from a wireless centric customer base to a growing software centric critical communications customer base as a critical strategic and operational element for the Company’s future. Each nominee, except for Mr. Butterfield and Ms. Hylton, has been involved in oversight of the Company’s strategic and operational priorities since 2004 and understands how the Company’s strategies and operations have evolved to support the Company’s continued long-term transition. The Nominating and Governance Committee believes that this historical understanding is critical and allows the nominees to judge the Company’s priorities and operational plans during the transition in a manner that would best impact long-term stockholder value. Based on this evaluation, the Nominating and Governance Committee believes that all nominees, including Mr. Butterfield and Ms. Hylton, should continue as directors on the Board. As the Company continues through its transition, the Nominating and Governance Committee will review each Director to ensure appropriate Board composition.

Annual Performance Evaluation

The Chair of the Nominating and Governance Committee oversees an annual Board evaluation process. The process consists of individual interviews using a five point grading mechanism on 59 different items of evaluation that cover Board independence, oversight of Company strategy, individual engagement and performance, quality of information and communication, and expertise and education, as well as committee performance. Each director is also given a chance to comment individually and confidentially regarding the Board’s function. On any points where the evaluation determines that the Board is performing at a less than excellent level, recommendations are made and executed for remediation of such condition.

Stockholders’ Communications

We have not developed a formal process by which stockholders may communicate directly to the Board. We believe that an informal process, in which stockholder communications (or summaries thereof)directed to the Board are received by the Secretary forand the Board’s attention andcommunications (or summaries thereof) are provided to the Board, has served the Board’s and the stockholders’ needs. All communications received are immediately communicated electronically to the Board or Committee Chairman, where appropriate. Responses, if appropriate, to these communications may come from the Secretary or a Board member. Until other procedures are developed, any communications to the Board should be addressed to the Board and sent in care of our Secretary at the following address: Spok Holdings, Inc., c/o Secretary, 6850 Versar Center, Suite 420, Springfield, Virginia 22151-4148.

16

| AUDIT COMMITTEE MATTERS |

AUDIT COMMITTEE REPORT FOR THE YEAR ENDED DECEMBER 31, 2014

To our Stockholders:

In accordance with its written charter adopted by the Board of Directors ("Board"), the Audit Committee assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the Company’s accounting, auditing and financial reporting practices. The Audit Committee oversees the financial reporting process on behalf of the Board.

Management is responsible for the preparation of the Company’s financial statements and financial reporting process, including the system of internal controls. Grant Thornton LLP (the “auditor”) is responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States of America and on the effectiveness of the Company’s internal control over financial reporting.

In discharging its oversight responsibility, the Audit Committee reviewed and discussed with management and the auditor the audited financial statements that were included in the Company’s 2014 Annual Report on Form 10-K.10-K for the year ended December 31, 2016.

The Audit Committee discussed with the auditor the matters required to be discussed under applicable Public Company Accounting Oversight Board (“PCAOB”) standards. In addition, the Audit Committee discussed with the auditor the auditor’s independence from the Company and its management and received the written disclosures and letter from the auditor as required by the applicable requirements of the PCAOB regarding the auditor’s communications with the Audit Committee concerning independence.

Based on the foregoing, the Audit Committee recommended to the Board and the Board approved the inclusion of the audited financial statements in the 2014Company's Annual Report on Form 10-K for the year ended December 31, 2016 for filing with the SEC.

Audit Committee:Committee*:

N. Blair Butterfield

Stacia A. Hylton

*Mr. Nicholas A. Gallopo, former Chair of the Audit Committee, died in November 2016. Mr. Matthew Oristano

The foregoing report shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Exchange Act (together, the “Acts”), except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under the Acts.

17

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES

The following table summarizes fees billed to us through April 1, 201527, 2017 by Grant Thornton LLP relating to services provided for the periods stated.

| Grant Thornton LLP | For the Year Ended December 31, | For the Year Ended December 31, | ||||||

| 2014 | 2013 | 2016 | 2015 | |||||

Audit Fees(1) | $1,367,048 | $1,486,037 | $1,210,203 | $1,331,622 | ||||

Audit-Related Fees(2) | — | 40,040 | 21,515 | — | ||||

Tax Fees | — | — | — | — | ||||

| All Other Fees | — | — | — | — | ||||

| Total | $1,367,048 | $1,526,077 | $1,231,718 | $1,331,622 | ||||

| (1) | The audit fees (including out-of-pocket expenses) for the years ended December 31, |

| (2) |

PRE-APPROVAL POLICIES AND PROCEDURES

The Audit Committee has adopted a policy and procedures relating to the approval of all audit and non-audit services that are to be performed by our independent registered public accounting firm. This policy generally provides that we will not engage our independent registered public accounting firm to render audit services unless the service is specifically approved in advance by the Audit Committee or the engagement is entered into pursuant to one of the pre-approval procedures described below.

From time to time, the Audit Committee may pre-approve specified types of services that are expected to be provided to us by our independent registered public accounting firm during the next twelve months. Any such pre-approval is detailed as to the particular service or types of services to be provided and is also generally subject to a maximum dollar amount.

The Audit Committee may also delegate to one or more of its members the authority to approve any audit or non-audit services to be provided by the independent registered public accounting firm. Any approval of services by a member of the Audit Committee pursuant to this delegated authority is reported at the next Audit Committee meeting.

All audit and audit-related fees in 20142016 and 20132015 were approved by the Audit Committee pursuant to our pre-approval policy.

18

| COMPENSATION COMMITTEE MATTERS |

INTRODUCTION

The Compensation Committee consists entirely of non-management directors all of whom are independent directors as the term is defined in the NASDAQ rules. Its responsibilities are described below and set forth in the Compensation Committee Charter that can be viewed online on the Company website at http://www.spok.com/our_company/investor_relations/meet-spok/investor-relations/. The current members of the Compensation Committee are: Brian O’Reilly (Chair), Samme L. Thompson and Royce Yudkoff.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None of the members of the Compensation Committee are or have been an officer or employee of the Company or had any relationship that is required to be disclosed as a transaction with a related person, except for Mr. Thompson whose relationship with American Tower Corporation (“ATC”), a landlord of transmission tower sites used by the Company, is described under “Transactions with Related Parties” on page 64.68. In addition, during 2014,2016, no member of our Board or of our Compensation Committee, and none of our executive officers, served as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of an entity that has one or more executive officers serving as members of our Board or our Compensation Committee.

COMPENSATION COMMITTEE PROCEDURES

Scope of Authority

The responsibilities of the Compensation Committee are set forth in its charter and include, among other duties, the responsibility to:

review and approve the Company’s overall executive compensation philosophy and design;

review and approve corporate goals and objectives relevant to the compensation of our CEO and all executive officers (including the NEOs);

make recommendations to the Board with respect to incentive compensation plans and equity based plans, administer and make awards under such plans and review the cumulative effect of its actions;

monitor compliance by executives with our stock ownership guidelines;

monitor risks related to the design of the Company’s compensation program;

determine the independence and lack of conflicts of interest of its outside compensation consultants;

review and discuss with management our Compensation Discussion and Analysis; and

prepare and approve the Compensation Committee’s Report for inclusion in the annual proxy statement.

In accordance with its charter, the Compensation Committee may delegate its authority to the Chair of the Compensation Committee when it deems appropriate, unless prohibited by law, regulation or NASDAQ listing standards.

Processes and Procedures for Establishing Executive Compensation

The primary processes and procedures for establishing and overseeing executive compensation include:

Compensation Committee Meetings. The Compensation Committee meets several times each year, withhad three meetingsformal meeting in 2014.2016 and conducted other deliberations by email in lieu of formal meetings. The Chair of the Compensation Committee, in consultation with the other members, sets the meeting agendas. The Compensation Committee reports its actions and recommendations to the Board.

Role of Consultants. In response toBased on the negative advisory Say-On-PaySay-on-Pay results in 2014, the Compensation Committee engaged as compensation consultants, Hay Group (“Hay”), to assist the Compensation Committee in evaluating the executive compensation of the NEOs. Hay was engaged to perform an assessment of executive compensation focused on:

19

Role of Management

The Company’s management provides input on overall executive compensation program design for the Compensation Committee’s consideration.

Each year, our CEO presents to the Compensation Committee recommendations for the compensation of the Company’s NEOs (other than himself), as well as certain other officers. The Compensation Committee reviews and discusses these recommendations with the CEO and, exercising its discretion, makes the final decision with respect to the compensation of these individuals. The CEO has no role in setting his own compensation.

At the beginning of each year, our CEO presents the Company’s proposed annual performance criteria to the Compensation Committee for the Compensation Committee’s consideration in establishing the short-term and long-term incentive compensationperformance criteria.

COMPENSATION COMMITTEE REPORT FOR THE YEAR ENDED DECEMBER 31, 2014

To our Stockholders:

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis contained on pages 2523 through 4351 of this Proxy Statement with management. Based on its review and discussions with management, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement.

Compensation Committee:

Brian O’Reilly, Chair

Samme L. Thompson

Royce Yudkoff

The foregoing report shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Acts, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under the Acts.

| EXECUTIVE COMPENSATION |

EXECUTIVE OFFICERS

Our NEOs and executive officers serve at the pleasure of the Board (only Messrs.Mr. Kelly and Balmforth havehas an employment contracts)contract). Set forth below is biographical information for each of our executive officers who are not also a director as of April 30, 2015.27, 2017. Our CEO, Mr. Kelly, is a director of the Company.

Bonnie K. Culp-Fingerhut (“Ms. Culp”), age 63,65, was appointed EVPExecutive Vice President ("EVP") of Human Resources and AdministrationChief Compliance Officer (“EVP, HR & Administration”CCO”) in October 2007. Ms. Culp was named SVPSenior Vice President ("SVP") of Human Resources and Administration in November 2004 with the merger of Arch Wireless, Inc. (“Arch”) and Metrocall Holdings, Inc. (“Metrocall”), predecessor companies to Spok. She was SVP of Human Resources and Administration of Metrocall from November 1998 until November 2004. Ms. Culp has more than 25 years of experience in the human resources field with over 15 years of experience in the wireless messaging industry. Ms. Culp is an NEO.

Shawn E. Endsley, age 59,62, was appointed CFOChief Accounting Officer ("CAO") of the Company on March 27, 2017 and remains a director of Arch, a wholly owned subsidiary of the Company. From September 2010 to March 2017, Mr. Endsley served as CFO of the Company in September 2011. Beforeand, before his appointment as CFO, Mr. Endsley had beenserved as our Controller and Chief Accounting Officer fromCAO since May 2005. Metrocall hired Mr. Endsley as Corporate Controller in June 2004. Prior to joining Metrocall, Mr. Endsley had over 20 years of experience in the telecommunications industry with financial or consulting positions at several publicly traded companies. These experiences included employment from 1989 to 1999 at Qwest Communications International Inc. and a predecessor company, of LCI International, Inc., both domestic telecommunications providers, as well as employment from 1999 to 2001 at Global Telesystems, Inc. an international provider of communication services. Mr. Endsley provided consulting and forensic accounting support at a large telecommunications company from 2002 to 2004. Prior to his career in the telecommunications industry, Mr. Endsley was employed by Arthur Andersen LLP to provide accounting, auditing and consulting services to utility and communication companies in the United States. Mr. Endsley is an NEO.

Hemant Goel, age 52,54, was appointed President of Spok, Inc. in June 2015. From October 2014 through June 2015 Mr. Goel served as Chief Operating Officer of Spok, Inc. in October 2014. Mr. Goel has global experience in healthcare information technology. Mr. Goel joined Spok, Inc. from Siemens Health Services (“Siemens”), where he was Vice President, Clinical SolutionSolutions (2008-2014), with worldwide

development responsibilities for the Clinical IT solutions business. In this position, he managed the organization’s operations, product portfolio, innovation and strategic growth. Mr. Goel also led a major software acquisition for Siemens. Before Siemens, Mr. Goel was Enterprise Vice President and General Manager, Radiology, Cardiology and Enterprise Imaging at Cerner Corporation (2001-2008), where he managed worldwide sales and development of this business unit. Previously, he was Senior Vice President, Business Development, Sales and Marketing at StorCOMM, Inc. (1999-2001), and, prior to that, served in various management positions at IMNET Systems, Inc., First Data Corporation and Unisys Corporation. Mr. Goel holds a Bachelor of Science degree in Mechanical Engineering from the Indian Institute of Technology in Kanpur, India, and a Master of Business Administration degree from the McColl School of Business at Queens University in Charlotte, North Carolina. Mr. Goel is an NEO.

Thomas G. Saine, age 52,54, was appointed Chief Information Officer (“CIO”) in August 2008. Prior to his current position, Mr. Saine was the Chief Technology Officer (“CTO”) since October 2007. Mr. Saine rejoined Spok in August 2007 as Vice President (“VP”) of Corporate Technical Operations. Previously, Mr. Saine had served Metrocall as VP, Technology and Integration from November 2003 through June 2005. Mr. Saine was an independent consultant from July 2005 through November 2005 and was a Program Manager and Director of Programs with Northrop Grumman Corporation from December 2005 through August 2007. Prior to Mr. Saine’s employment with Metrocall in 2003, Mr. Saine had served as VP, Network Services and CTO of Weblink Wireless, Inc. from 2001 through 2003. Mr. Saine has over 2025 years of operations, engineering and technology management experience.experience within the communications industry. Mr. Saine currently serves on the Board of Spok Canada. Mr. Saine served in the US Navy from 1980 through 1987. He is a Certified Information Systems Security Professional (CISSP) and has a Bachelor of Science in Management from California Coast University and a Masters of Science in Engineering Management from Columbus University. Mr. Saine is an NEO.

21

Michael W. Wallace, age 48, was appointed CFO of the Company on March 27, 2017. Before his appointment as CFO, Mr. Wallace had been Executive Vice President and CFO of Intermedix Corporation ("Intermedix"), a healthcare revenue cycle/practice management and data analytics solution provider since August 2013. Prior to joining Intermedix, Mr. Wallace was Executive Vice President and CFO of the Elephant Group (d.b.a. Saveology.com), an Internet based, direct to consumer marketing platform from October 2008. Before The Elephant Group, Mr. Wallace served as Senior Vice President and CFO of Radiology Corporation of America, a national provider of mobile and fixed-site positron emission tomography (PET) imaging services. Mr. Wallace has also served as an Assistant Chief Accountant in the SEC's Division of Enforcement and was a member of the SEC's Financial Fraud Task Force in Washington, D.C. Prior to his time at the SEC, Mr. Wallace served as CFO at Inktel Direct, Corp. CELLIT Technologies, Inc. and Kellstrom Industries, Inc. Before joining Kellstrom, Mr. Wallace worked at KPMG Peat Marwick, LLP in Miami, Florida. Effective March 27, 2017, Mr. Wallace will be an NEO.

Sharon Woods Keisling (“Ms. Woods”), age 46,48, was appointed Corporate Secretary of Spok in July 2007 and Treasurer in October 2008. She oversees Spok’s treasury operations, facilities and legal. Ms. Woods was named VP of Treasury Operations with the merger of Arch and Metrocall. Prior to this appointment, Ms. Woods held positions in Accounts Receivable and IT. Ms. Woods has over 25 years of experience in the communications industry. She received a Bachelor of Arts in Accounting from Kings College.

| COMPENSATION DISCUSSION AND ANALYSIS - TABLE OF CONTENTS |

| COMPENSATION TABLES | ||

| COMPENSATION DISCUSSION AND ANALYSIS |

INTRODUCTION

We will provide a detailed discussion of our executive compensation with a focus on the Compensation Committee’s decisions with respect to our NEO’s.NEOs. Our NEOs in 20142016 were:

| NAME | POSITION |

Vincent D. Kelly | President and Chief Executive Officer |

| Hemant Goel | President, Spok, Inc. |

Shawn E. Endsley(1) | Chief Accounting Officer (Former Chief Financial Officer) |

| Thomas G. Saine | Chief Information Officer |

| Bonnie K. Culp-Fingerhut | Executive Vice President – Human Resource and Chief |

| (1) | Mr. Endsley served as our CFO during fiscal year 2016. Effective March 27, 2017, Mr. Michael Wallace was appointed CFO and Mr. Endsley became CAO. Mr. Wallace will be an NEO in 2017. |

EXECUTIVE SUMMARY

Say on Pay Results in 2016 and Stockholder Outreach

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 provides stockholders with a non-binding advisory vote (“Say on Pay”Say-on-Pay”) on the compensation of our NEOs as such compensation is disclosed in our annual proxy statement. We hold this votethese votes annually. In 2014,At our 2016 Annual Meeting the 2015 NEO compensation program was approved by 99.1% of the votes cast, 52.0% voted againstshares voting (excludes broker non-votes). Based on the significant support that our 2015 NEO compensation program received from stockholders, our Compensation Committee made no fundamental changes to our 2016 NEO Compensation Program. Through our stockholder outreach in 2016 and through April 2017 we obtained feedback from our stockholders on our operational and financial performance as well as our NEO compensation on an advisory basis. In addition, the three directors on the Compensation Committee did not receive greater than 80% approval of the votes cast. In light of the results of the advisory vote, the Compensation Committeepay practices. This 2016 and management conducted2017 stockholder outreach to obtain feedback on our NEO compensation practices (and other corporate matters). This stockholder outreach involved:consisted of:

| 1) |

| 2) |

| 3) | Speaking with stockholders representing approximately 26.7% of our outstanding shares throughout the year, including four of our ten largest stockholders. |

A more detailed discussion of our stockholder outreach is included in the section “Stockholder Outreach”"Stockholder Outreach" on page 30.

| 1) |

| 2) |

| 3) |

| 4) |

| 5) |

Following significant support for our 2015 Executive Compensation Program as evidenced by the results of our Say-on-Pay vote at our 2016 Annual Meeting and based on positive feedback from stockholders, the Compensation Committee designed the 2016 Executive Compensation Program to be consistent with the 2015 Executive Compensation Program (see page 35) and did not make any fundamental changes for 2016.

24

Compensation Philosophy

The compensation philosophy of our Company is intended to motivate executives to achieve Spok’s strategic goals and operational plans and attract and retain high quality talent while the Company transitions from a wireless centric customer base to a growing software centric critical communications customer base. This philosophy is supported by an executive compensation program centered onincluding a pay-for-performance objective that aligns executive compensation with stockholder value. That philosophy is translated into the executive compensation program design based on the following principles.